Cost Not Basis to Avoid Arbitration

Texas courts favor arbitration and generally enforce arbitration provisions. But, what if a party cannot afford the arbitration fees? Are the costs of arbitration grounds for a court to hold that provision unenforceable? The Texas Supreme Court recently answered these questions.

In Houston AN USA, LLC d/b/a AutoNation USA Houston v. Walter Shattenkirk, an employee filed suit against his former employer alleging he was terminated due to discrimination and retaliation. The employer moved to compel arbitration arguing that the employee entered into a binding arbitration agreement when he accept

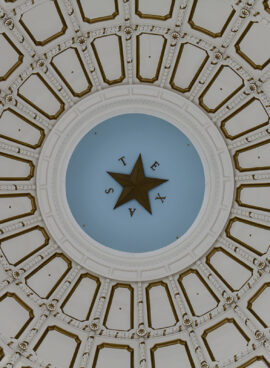

Texas Legislative Update 2023

The Texas Legislature’s general session concluded on May 29, 2023 with several very important pieces of legislation being passed. The Legislature was unable to resolve issues related to property tax relief and border security and Governor Abbott has a called for a Special Session to address those issues. Several of the bills which did pass will impact both construction and businesses in the State of Texas and include the following.

HB 1255 – Limitation Periods on Arbitration Proceedings

Summary: HB 1255 makes it clear that statutes of limitation apply and will bar claims in arbitrat

$44 Million Dallas Verdict for Electric Shock

On April 18, 2023, a Dallas jury awarded $44 million in damages to a Texas homeowner who was rendered a paraplegic from an electric shock when trying to cut trim trees near a high-voltage power line. How did this happen?

The Taylors own a rental house on a corner lot in Graham, Texas. The Shifletts own the house next door. Both houses receive electrical power from lines owned and operated by Oncor Electric Delivery Company, LLC (Oncor). A 7,200 volt uninsulated power line runs to the corner of the Taylors’ property and two 240 volt insulated service lines, one running to the Taylors’

Loosened Standards for Suing Foreign Companies in Texas

When can a foreign company be haled into Texas court? For many years, the Texas Supreme Court has hewed closely to US Supreme Court precedent when it comes to exercising personal jurisdiction over a party. In a recent decision, however, the Texas Supreme Court has signaled it is open to applying a broader standard, making it easier to bring and keep suit against foreign companies.

On May 5, 2023, the Texas Supreme Court ruled that Texas courts may exercise personal jurisdiction over a foreign entity when that entity controls the means, details, and manner in which an American subsidiary condu

Confidentiality of Umbrella Insurance Policies

Are umbrella insurance policies confidential documents that can be subject to protection from further disclosure through a protective order? The Dallas Court of Appeals recently answered this question, refusing to disturb a trial court’s ruling that umbrella policies are not confidential documents.

In In re Lyft, Inc., No. 05-23-00079-CV, 2023 WL 3000565 (Tex. App.—Dallas, Apr. 19, 2023), three passengers sued Lyft and the Lyft driver for injuries allegedly sustained in a car crash involving the Lyft driver. As part of routine discovery, plaintiffs requested copies of documents from Lyft

$860 Million for Crane Collapse

In April 2023, a Dallas County jury awarded over $860 million to the family of a woman killed when a crane collapsed on her apartment complex. The jury’s award against real estate developer, Greystar Development & Construction, LP (Greystar), was $160 million more than the Plaintiffs requested. How did this happen?

During a severe thunderstorm on June 9, 2019, a tower crane collapsed on the Elan City Lights Apartment Community in Dallas. The collapse injured several residents of the Elan and killed Kiersten Smith. Shortly after the collapse, Smith’s family sued Greystar and two other e

$5.1 Million for Religious Discrimination

Can an employer be justified in terminating an employee for violating the employer’s policies and at the same be liable for religious discrimination under Title VII? Southwest Airlines recently learned that the answer is, “yes”, and faces a $5.1 million verdict in its former employee’s favor.

Southwest Airlines terminated flight attendant Charlene Carter in 2017 after 20 years of service, determining that Carter’s behavior violated Southwest’s Social Media Policy, Workplace Bullying and Hazing Policy, and Harassment Policy. Carter filed a grievance against Southwest pursuant to